What is a Tax Transcript and Why Do We Need it?

In the process of getting your loan from the initial application to the closing table, you may feel like you’ve taken on a part time job managing paperwork. Believe it or not, there are many documents required for underwriting and funding your loan that are obtained behind the scenes without you. That sounds pretty sketchy, actually, but part of your initial disclosure package will include authorizations for us to verify the information on the application.

Why do you need to verify all this? I turned in the documents!

Most borrowers are honest people and are understandably confused by why we would need to do something like verify your tax returns and related forms with the IRS. Sometimes we order these documents if you can’t find a W2 from a past job or there are missing pages of your tax return, but more typically they are just needed to verify the documents that you provided are actually the ones that were filed with the IRS. That sounds crazy, I’m sure, but at least once a year I find that someone has provided a tax return or W2 for loan qualification that paints a very different picture than the ones that were actually filed. Yikes!

So, why is someone asking ME to find this?

Unfortunately, the process of ordering these transcripts can sometimes go sideways. Most commonly, the request can be rejected if your address on your tax return does not match the address on your loan application, but there are any number of reasons we can wait the 7-10 days and receive a rejection rather than what we needed to finalize your loan. In those cases, we may ask you to obtain the transcripts and provide them, since you can access them instantly. Here’s how:

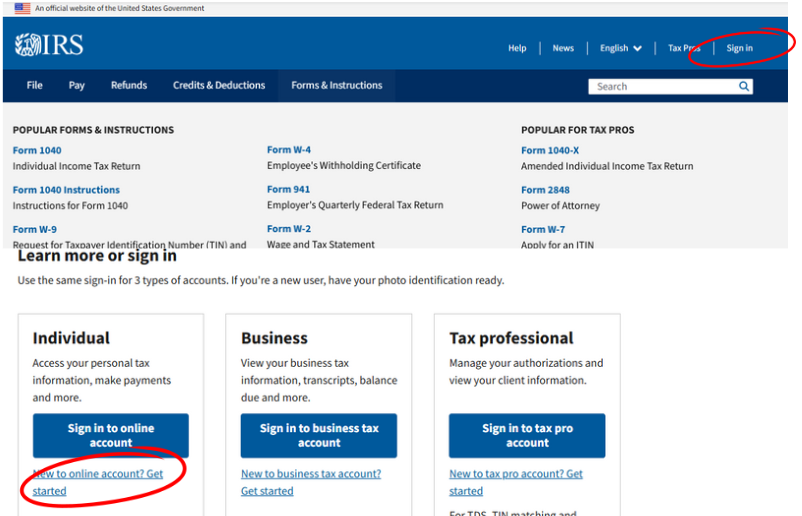

Visit IRS.GOV and select “Sign In” then either log in or create an account

Where to click to log in and/or create an account

If you do not have an ID.me login, follow the prompts to create one

This application is used across several government websites and will require certain steps to confirm your identity. You can either complete a short video call with an employee or select the self service option. I recommend the self service option, which is straightforward- you will upload a picture of your photo ID and then follow the prompts to submit a video selfie and the software will confirm a match. It sounds worse than it is! I just completed the process for the sake of this article and it took just a couple minutes. More info on the ID.me website

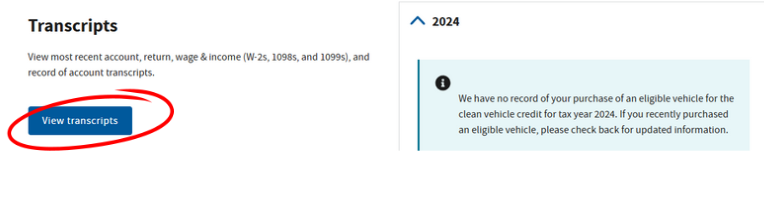

Once Logged in, select “Records and Status” in the navigation bar then “Tax Records” and “View Transcripts”

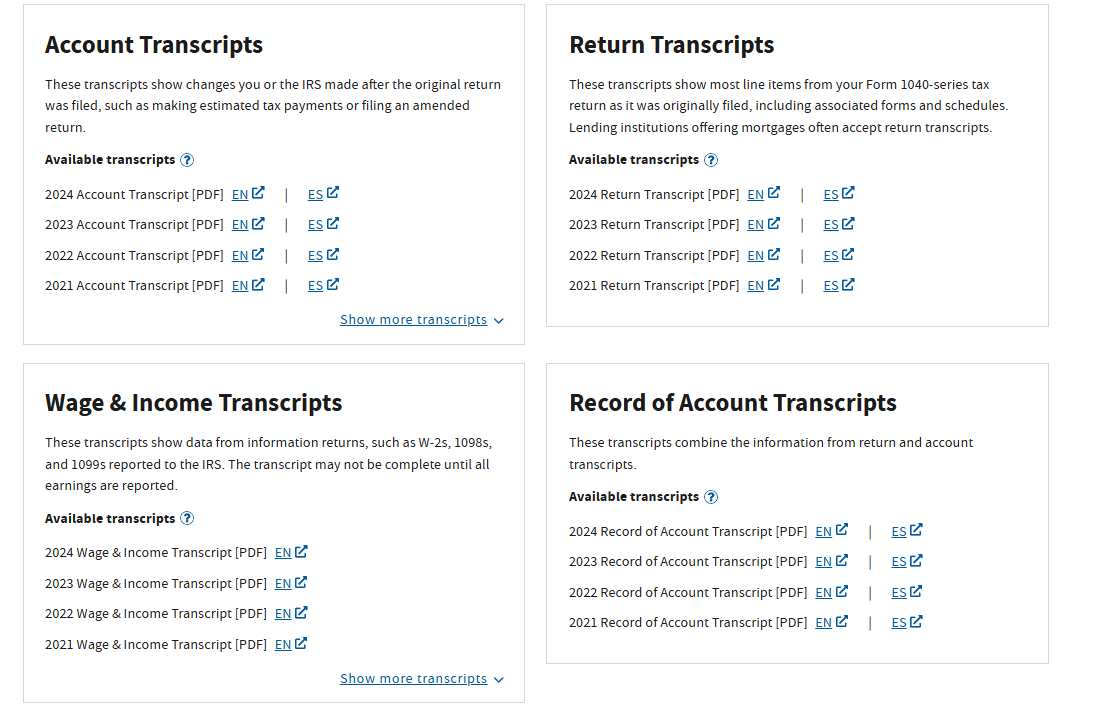

Download the required transcript type and year

Your lender should let you know which transcript type is required. For mortgage purposes, the account transcript can be used to verify that there is no remaining payment due (remember that spot on the application that asked if you are delinquent on any federal debt? Unpaid taxes count!) and any changes made after the initial filing such as amendments or payments applied on a payment plan. Return Transcripts contain the data that was input on your tax return to verify that the return used to underwrite your loan is the same one that was filed. Wage & Income Transcripts contain records of all W2s and 1099s that you received for cases where those need to be verified or when they are missing.